Chronology

- Subscription: October 14, 2017

- Approval: June 18, 2022 DOF - Diario Oficial de la Federación (Official Gazette of the Federation)

- Entry into force: July 2, 2023

- SHCP Announcement: July 5, 2023

- Implementation: January 1, 2024

What is it?

The Pacific Alliance is made up of Chile, Colombia, Mexico and Peru, which signed the "Convention to Standardize the Tax Treatment provided for in the Double Taxation Avoidance Agreements signed between the States Parties to the Pacific Alliance Framework Agreement", with the purpose of modifying the bilateral double taxation avoidance agreements signed between countries, in order to contribute to the economic reactivation of the region.

What does it establish?

The convention establishes the following:

- Pension Funds

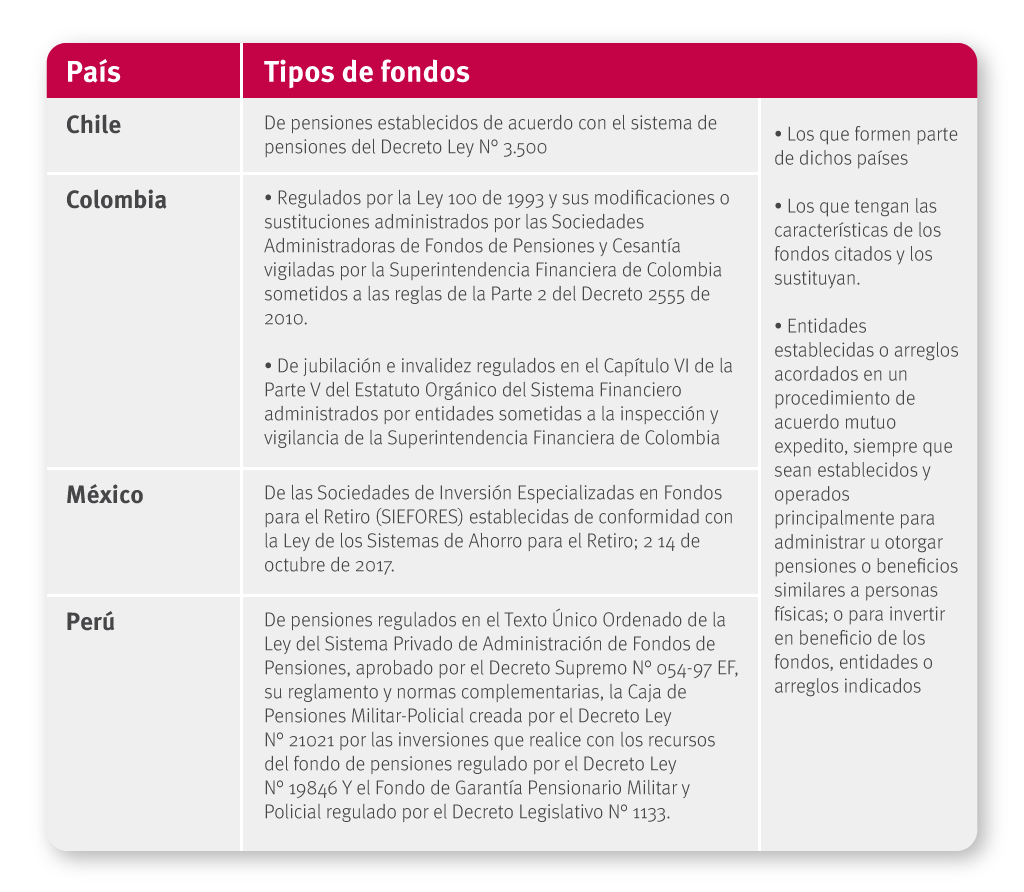

It recognizes pension funds as residents for purposes of the application of the agreements to avoid double taxation, so that such funds may apply the benefits of such agreements and will be considered effective beneficiaries. For such purposes, the following are considered pension funds:

Interest and capital gains

Equalizes the tax treatment for interest income and capital gains from the sale of shares through a stock exchange that is part of the Latin American Integrated Market (MILA) and received by pension funds.

a) Interest: It is established that interest from any of the member countries whose recipient is a recognized pension fund also from any of the member countries, will be taxed in the country of residence of the recipient and not of the source; however, it may be taxed in the country of source, but the tax may not exceed 10% of the gross amount of the interest. However, the tax treatment of the treaties may be applied when the interest is taxed at less than 10% of the gross amount of the interest or is exempt in the member country from which the interest arises due to the legal nature of the debtor.

b) Capital gains: Capital gains obtained by a recognized pension fund of a member country from the sale of shares representing the capital of a company that is a resident of a country that is a Party to the Convention through a stock exchange that is part of the Latin American Integrated Market (MILA), can only be subject to taxation in the country mentioned first (residence).

It should be noted that, with respect to Peru and Mexico, the convention will apply, although the protocol to the double taxation avoidance treaty between those countries is not applicable when the recipient of the interest income or capital gains, as applicable, being a resident of one of those countries, is not subject to taxation or is exempt with respect to such income under the laws of the country of residence.

Source: Convention-para-homologar-el-tratamiento-impositivo.pdf (alianzapacifico.net)