Due to the most recent controls that the authorities are using for the identification, review and valuation of intercompany transactions carried out within national or multinational Business Groups, transfer pricing has become relevant and has become a planning tool, with the purpose of determining that the consideration agreed upon in transactions between related parties is agreed upon at fair market value and thus avoid tax evasion or unfair competition.

As part of the main changes in this matter that we can observe in the tax reform for fiscal year 2022, was the change in the dates of compliance with the transfer pricing obligations, as well as the inclusion in Annex 9 of the "Multiple Informative Declaration" regarding the information of the operations with related parties resident in national territory, so all those taxpayers that carry out intercompany operations regardless of their tax residence, have to present this informative declaration.

However, on December 27, 2022, the Miscellaneous Tax Resolution (RMF) for 2023 and its Annexes were published in the Official Gazette of the Federation (DOF), which is effective as of January 1, 2023. As part of this RMF, rule 3.9.19. regarding transfer pricing is incorporated, which states that taxpayers that carry out transactions with related parties may not submit the information in Annex 9 of the Multiple Informative Declaration (DIM), provided that the taxpayers that carry out business activities do not exceed 13 million pesos in the immediately preceding fiscal year, or that they have not exceeded 3 million pesos in the rendering of professional services in such fiscal year.

It should be recalled that, previously, the income limit for the presentation of this schedule was not defined; therefore, taxpayers that carried out transactions with related parties resident abroad and in Mexican territory had to present this information without considering the amount of income obtained.

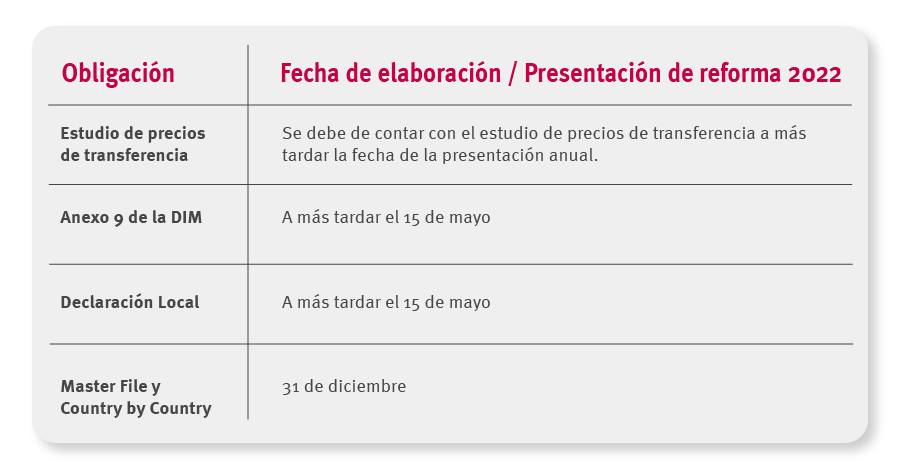

The following are the transfer pricing obligations, as well as the filing dates for each of them for fiscal year 2022: